Maintaining your finances and making all monthly payments on time may seem difficult. You can accomplish it if you know how to use the right strategies to stay organized. Here are some pointers on how to handle money and expenses more effectively, including how to transfer funds across accounts, pay your gas and electricity bills, and make the most use of your account.

Financial Management

You must have a clear picture of your finances before you can start financial management. First, make a detailed budget that includes all of your income and expenses, such as your gas and electric bills. This simple step helps you set a budget for expenses and save money for later.

Using Personal Finance Apps

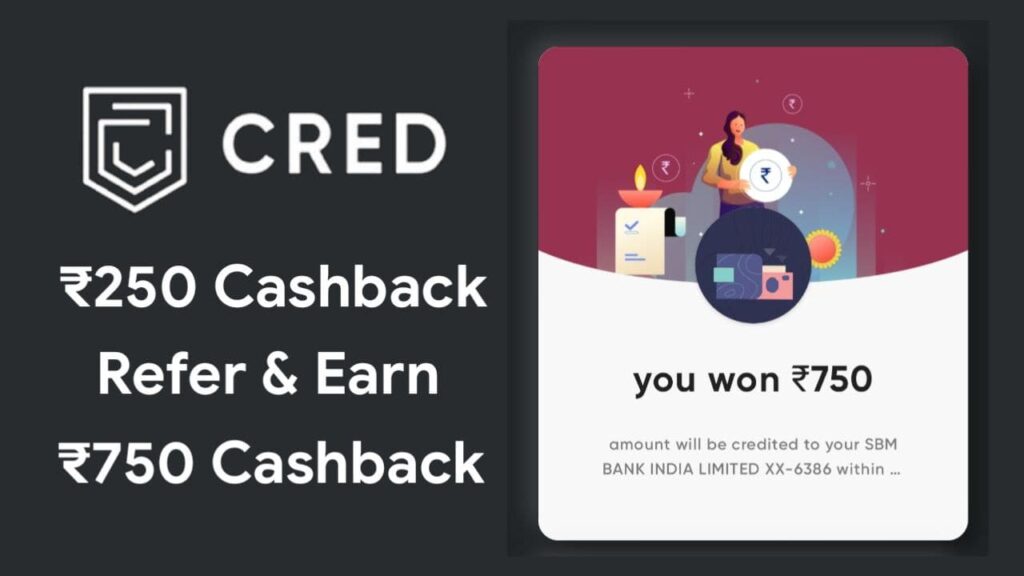

Personal Finance apps can help you plan and keep track of your spending. These apps can help you spend less, stick to your budget, and remember to pay your bills, among other useful things. They will help you pay all your bills. When you’re looking for apps, make sure they can properly connect to your bank accounts and send and receive money.

How to Choose the Best App to Pay Your Electricity Bill

The right app can help you remember to pay your electricity bills on time. With a useful electricity bill pay app, you can pay your bills right away when you get notifications that bills are due.

Managing gas bill payments online

It’s simple to make gas bill payments online. In fact, there is more than one way to pay your gas bills online. Pick ones that let you pay with digital wallets, bank transfers, credit or debit cards, and other ways. You should also be able to see old bills so you can save money and keep track of what you’ve spent. Make sure the platform has encryption and other safety features if you want to use it for shopping.

Fund Transfer

You need reliable apps to send money to another person or account. These apps allow you to do a fund transfer quickly. Check out how many different apps charge to send money to get the best deal. Use apps with good protection to keep your money safe.

Strategies for effective bill management

These tips might help you remember to pay your bills:

Reminders:

You can use money apps and calendar alerts to help you remember when your bills are due.

Automate Payments:

Set up your bills to be paid on their own to ensure you always do so. This way, you won’t have to pay as many late fees.

Budget Adjustment:

Check your budget often if you want to reach your financial goals, or make changes to it according to your expenses and income.

Conclusion

Paying bills on time each month helps you avoid debt and reach your financial goals. Use personal finance applications, pay your bills properly, and plan your spending to simplify and manage your money.

With this new tech and these tips, paying your bills will be easier and less stressful. You can also handle your money better. Now is the time to think about your money. Use these tips to keep track of your bills.