Personal money management doesn’t need to be a difficult problem, even though it sometimes feels like one. With the right tools, everyone can take oversight over their financial well-being. One such technology that has completely changed the way people manage their finances is the budget app, which allows its users to track their spending, create savings targets, and monitor their overall financial well-being.

Why online budgeting is a game changer?

Traditional budgeting techniques like worksheets and written documents are becoming outdated in the age of technology. These days, managing your money in the current time and with greater efficiency is possible with online budgeting. Budget software may effortlessly connect to your bank savings accounts, credit cards, and other fiscal services to provide you with an updated picture of your financial health. This method makes your budgeting more accurate and dependable while also saving time and lowering the possibility of human error.

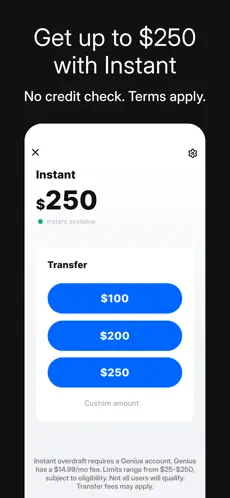

Even with the greatest of budgets, there can occasionally be situations when you need extra money. The ability to borrow money might be essential for either predicted or unforeseen costs. However, taking out loans without a strategy can result in debt. This is where budget apps come in handy; they help you include borrowed money into your spending plan so you can make sure you can pay it back without risking your stability.

How to make the most out of your budgeting app?

It’s important to use the budget app you’ve chosen regularly. By keeping an eye on the money you spend, regularly adjusting your budget, and revising your objectives, you can remain on course. Almost all systems provide the ability to set alerts for when you’re nearing your budget constraints, which is a great help in managing your spending. The ability to view your financial data from anywhere at any time is another benefit of using budget tools for online budgeting, especially for people who have to deal with their money while they are on the go.

Why is choosing the right application necessary?

Selecting the best app can be difficult due to the availability of inexpensive options available on the market. Finding an app that works for you is crucial, regardless of whether your goals are budgeting, debt management, or saving money. While some applications offer more sophisticated features like automated savings or investment management, others are primarily focused on tracking everyday expenses.

A popular software that frequently appears in chats is Rocket Money, which is well-known for its extensive financial features and easy-to-use interface. Before choosing an app, it’s critical to evaluate the benefits and drawbacks of several, taking into account aspects like price, functionality, and usability.

Conclusion:

Managing your finances doesn’t have to be complicated. With the right budget app, online budgeting comes as a breeze, helping you achieve your financial goals in an expertised way. Whether you need to borrow money or simply wish to handle your spending better, a budgeting tool can help you save more and spend smarter. Start embracing the simplicity and convenience of online budgeting, and watch your financial confidence grow.